Robohub.org

Maybe we need an automation tax

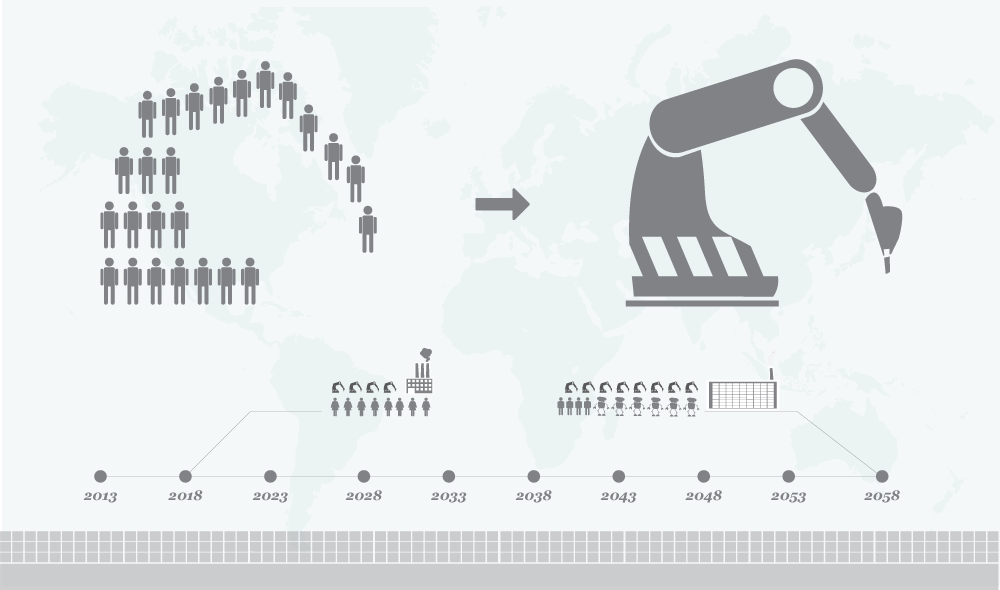

Imagine that a large company decides to significantly increase the level of automation at one of its facilities. A facility that currently employs a substantial number of men and women doing relatively low-skill tasks, which can now be done by a new generation of robots. Most of the workers get laid off, which for them and their families, leads to real hardship. The company was the only large employer in the area, which is economically depressed (one of the reasons perhaps that the company built the facility there in the first place), so finding alternative work is really difficult. And because most of those jobs were minimum wage, with little or no job security, redundancy payouts are small or non-existent, and this of course means that the laid-off workers have no financial buffer to help them re-skill or relocate.

Imagine that a large company decides to significantly increase the level of automation at one of its facilities. A facility that currently employs a substantial number of men and women doing relatively low-skill tasks, which can now be done by a new generation of robots. Most of the workers get laid off, which for them and their families, leads to real hardship. The company was the only large employer in the area, which is economically depressed (one of the reasons perhaps that the company built the facility there in the first place), so finding alternative work is really difficult. And because most of those jobs were minimum wage, with little or no job security, redundancy payouts are small or non-existent, and this of course means that the laid-off workers have no financial buffer to help them re-skill or relocate.

Now I am not anti-automation. Absolutely not. But I believe very strongly that the benefits of robotics and automation should be shared by all. And not just the shareholders of a relatively small number of very large companies. After all, the technology that such companies benefit from was developed by publicly funded research in university research labs. In other words research that you and I funded through our taxes. Ok, you might say, but companies pay tax too, aren’t those taxes also contributing to that research? Yes, that’s true. But large companies are very good at reducing their tax bill, multinationals especially. Our imaginary company may, in reality, pay most of its tax in a different country entirely from the one hosting the facility.

And of course it is we, through local and national taxation, who – as best we can – pick up the pieces to support the laid off workers and their families, through family tax credits, employment and support allowance, and so on.

Maybe we need an automation tax?

It would be a tax levied nationally, whenever a company introduces robotics and automation to one of its facilities in that country. But the tax would only be payable under certain conditions, so for instance:

- If the new robotics and automation causes no-one to be laid off, then no tax is due.

- If the automation does result in jobs becoming redundant, but the company re-trains and re-deploys those workers within its organisation, then no tax is due.

- If the company does lay off workers but makes a tax-free redundancy payment to those workers – regardless of their contract status – sufficient to cover the full costs of retraining, upskilling, and – with all reasonable efforts – finding work elsewhere, then no tax is due.

Only if none of these conditions are met, would the automation tax be due. The idea is not to discourage automation, but to encourage companies to accept a high degree of responsibility to workers laid off as a result of automation, and more widely their social responsibility to the communities in which they are located. The tax would enforce the social contract between companies and society.

Of course this automation tax doesn’t go anywhere near far enough. I think the best way of sharing the wealth created by robotics and automation is through a universal Basic Income, but until that utopian condition can be reached, perhaps an automation tax is a start.

If you liked this article, you may also be interested in:

- Me, myself and robots: Could basic income guarantees level the playing field?

- Obama connects robots to jobs in State of the Union address

- Robots will augment jobs, not take them

- Finally somebody debunks the Pew Research Center’s “AI, Robotics, and the Future of Jobs” report

- Four recent videos about robots and jobs

- The fate of jobs in relation to robotics is confusing

See all the latest robotics news on Robohub, or sign up for our weekly newsletter.

tags: c-Politics-Law-Society, robots and jobs