Robohub.org

Who are the most active robotics investors?

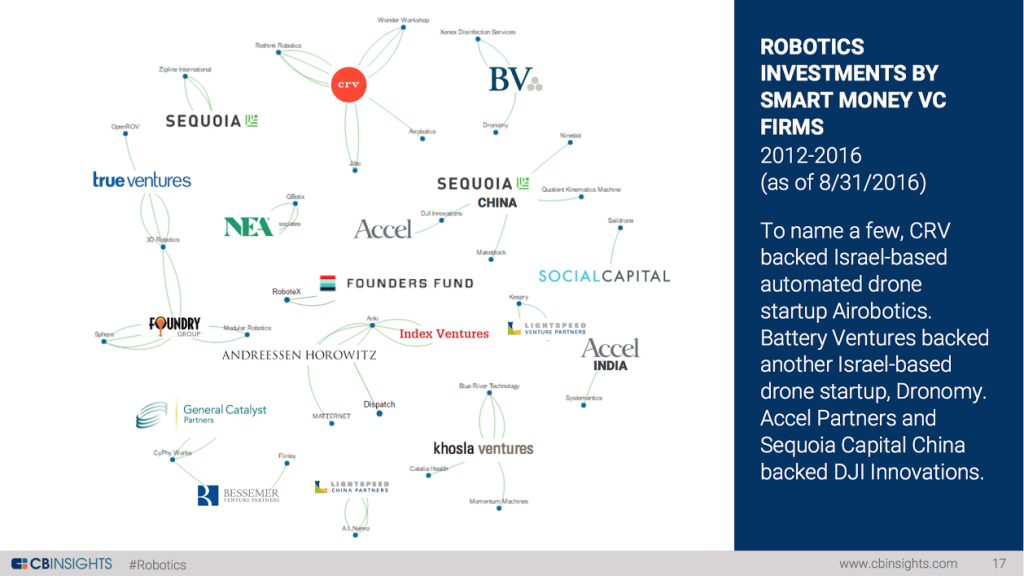

You may be surprised, but I’m not. These are the people I see regularly both in Silicon Valley and overseas interacting with the robotics community. That makes them the smart money (most of the time). According to CB Insights, the 7 most active robotics investors over the last 5 years are: Eclipse Ventures, High-Tech Gründerfonds, Lux, Intel Capital, Sequoia China, CRV, and Visionaire Ventures.

As CB Insights demonstrates, old school ‘smart money’ is still making investments in robotics — just at a slower pace. Overall, the last 5 years has seen an increase in global robotics equity funding to $2.6 billion in 405 deals.

Eclipse Ventures is a $125m hardware fund. which ‘backs iconic entrepreneurs building vertically integrated companies incorporating hardware, software and data.’ Some of their portfolio companies include; Kinema Systems, Marble, Modbot, Rise Robotics, and Clearpath Robotics.

High-Tech Gründerfonds is Germany’s most active and leading seed-stage investor across fields of cleantech, biotech and robotics, with e576m in two funds. Portfolio companies include; REVOBOTIK, Bionic Robotics, Magazino, Reactive Robotics, Medineering.

Lux Capital has $700m under management and ‘invests in emerging science and technology ventures at the outermost edges of what is possible’. Some of their portfolio companies include; Saildrone, Tempo Automation, CyPhy Works and Auris Surgical Robots.

Intel Capital has had more portfolio exits than any other venture capital firm since 2005. Intel Capital is stage agnostic, across a wide range of technologies. Portfolio companies include; Ninebot, Yuneec, Savioke, and Persimmon Technologies.

Sequoia has invested in an unprecedented number of enormously successful companies, including Apple, Google, Electronic Arts, LinkedIn, Dropbox, and WhatsApp. Today, Sequoia has robust connections to the four most innovative and fastest-changing economies in the world: China, India, Israel, and the United States. Sequoia China portfolio companies include; Ninebot, Makeblock, Quotient Kinematics Machine, and DJI Innovations.

CRV, aka Charles River Ventures, has over $2.1b under management with more than 40 years of experience in 16 funds. Some portfolio companies include; Jibo, Wonder Workshop, Airobotics, and Rethink Robotics

Visionaire Ventures has just closed a second $200m fund and is investing in companies from artificial intelligence to machine/deep learning, robotic automation, visual perception, agricultural and digital health technologies. Portfolio companies include; CANVAS Technology, Modbot, Savioke, and Zipline International.

tags: Andra Keay, c-Business-Finance, silicon valley robotics