Robohub.org

IFR predicts double digit growth for service robots through 2018

The service robotics industry is relatively new, diverse and picking up steam daily. Service robotics covers every activity except those described as industrial. These are robots that perform useful tasks for humans and are categorized as either personal or professional.

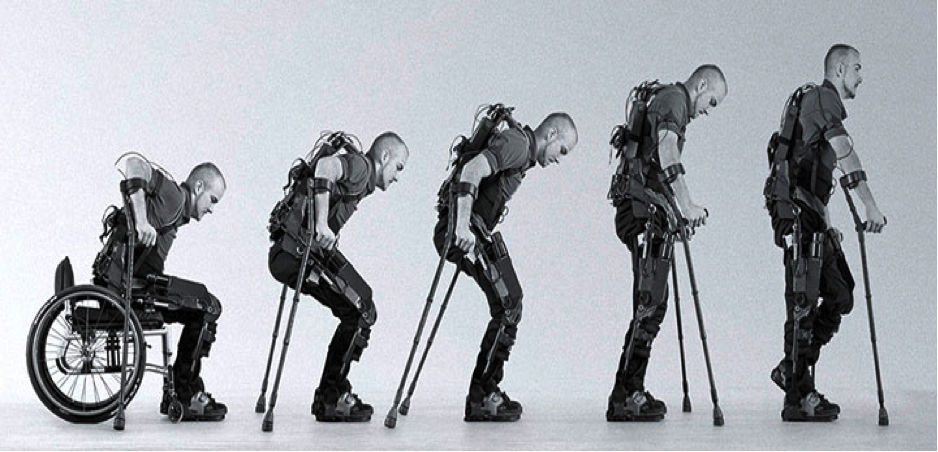

Service robots cross definitional borders. They collaborate safely with humans and they move goods of all types for all kinds of purposes. Mobile robots fly, swim, run, jump, clean and glide. They milk. They help. They assist in factories, shops, homes and hospitals. One significant difference between industrial and service robots is that, for the latter, there is no multiplier for additional costs associated with getting the robot up and operating in a safe fixed location. Service robots, particularly service robots for personal and private use, tend to be self-contained and/or plug and play and not in need of integration services, as is the case with industrial robots.

Service robots cross definitional borders. They collaborate safely with humans and they move goods of all types for all kinds of purposes. Mobile robots fly, swim, run, jump, clean and glide. They milk. They help. They assist in factories, shops, homes and hospitals. One significant difference between industrial and service robots is that, for the latter, there is no multiplier for additional costs associated with getting the robot up and operating in a safe fixed location. Service robots, particularly service robots for personal and private use, tend to be self-contained and/or plug and play and not in need of integration services, as is the case with industrial robots.

The International Federation of Robotics (IFR) have just published their World Robotics Service Robots statistical review of 2014 (with projections through to 2018). The 226-page $675 report details the sales revenue and units sold by category from a database of approximately 300 service robot manufacturers around the globe.

The International Federation of Robotics (IFR) have just published their World Robotics Service Robots statistical review of 2014 (with projections through to 2018). The 226-page $675 report details the sales revenue and units sold by category from a database of approximately 300 service robot manufacturers around the globe.

Revenue from the sale of industrial robots was $10.7bin, with an additional $21.3bn in spending for supporting services such as integration, peripherals, software and systems engineering — so $32bn in total. Service robotics (both professional and private) totaled $5.97bn. Therefore, the combined value of the robotics industry – service, support and industrial – for 2014 was $38bn.

- In 2014, professional service robotics rose by 11.5% from 2013. 24,207 units were sold at a value of $3.77bn. The IFR is projecting a growth rate of 19% in units and 11% in dollars through to 2018, 36,750 units and $5.7bn projected for 2018 (respectively).

- Defense applications represent 45% of those figures (unmanned aerial vehicles followed by bomb fighting and de-mining robots).

- Milking robots represented 24%, leaving 31% for medical and logistical robots.

- In 2014 personal service robotics rose 28% over 2013, with a value of $2.2 bn for 4.7 million units. The IFR is forecasting a growth rate of 27% in units and 35% in dollars through to 2018, with 12.25 million units and $7.3bn projected for 2018.

- Household items (floor and window cleaners and lawn mowers) with higher price points account for the higher revenue increase over the percentage for units sold.

There are many, many variables that could seriously alter these projections. The IFR acknowledges this problem as follows:

The 4 year projections are conservative due to the character of the company feed-back. Typically companies only report projections of sales of existing products (or at least pre-series products that are about to be launched). Therefore a future product, Jibo for example, is not reported and counted.

Nevertheless, the projections are very likely to be seriously understated for a variety of possible reasons. For example:

- The acceptance and sale of hundreds of thousands of Pepper robots,

- An increased rate of adoption of home floor cleaning robots in the Asian marketplace similar to the success of iRobot in the English-speaking world,

- The acceptance and sale of millions of Jibo and other table-top robotic assistance devices,

- A near-term solution which enables collision avoidance, thereby letting mass quantities of drones and drone deliveries into the national air space,

- The collaborative robot marketplace could take off at an even greater rate than the present 70% year-over-year sales increase, as new low-cost robots are quickly trained and put to work for SMEs around the globe.

[The IFR produced their report and based their projections on a limited database of 300 service robot companies of which 15% were startups. The Robot Report’s database contains over 900 service robot companies and an additional 400 startups. The IFR’s distribution is: 23% from Asia, 36% from the US and Canada, and 41% from the UK, EU and elsewhere. The Robot Report’s database is quite similarly distributed for service companies. It significantly varies in where the startups are located: only 12% in Asia, 48% in the US and Canada, and 40% in the UK, EU, Israel and elsewhere.]

tags: c-Consumer-Household, cx-Business-Finance, ifr, service robots