Robohub.org

April equity deals, acquisitions and Chinese funds

Money is flowing to robotics-related startup companies. Q1 saw nineteen equity deals totalling $317 million, and three acquisitions of undetermined amounts, but money also flowed in April.

Equity deals:

- Airware, already the most heavily venture-backed drone company in Silicon Valley, received an undisclosed investment from Intel Capital. Airware has developed an autopilot that enables drone makers to quickly build their device, pop in the Airware box, add their special application-specific payload, and not have to develop extensive piloting and navigation software.

- Gamma2 Robotics closed a $3.5M Series A round with a goal of rolling out their mobile Vigilant Security Robots. Funds came from Foxlink, a Taiwan-based electronics manufacturer who said: “We believe that it represents a sea change in the security industry, where no longer are human guards burdened with the dull, dirty and dangerous jobs. They can be reallocated to more high-value roles, leaving the robots to do the previous job at a technically superior level, at a fraction of the cost. We see – and are actively pursuing – immediate applications around the world.”

Acquisitons:

- SMD, a UK ROV builder and underwater services provider, was sold to a Chinese conglomerate for $190M.

- Beijing-based Ninebot acquired Segway and received $80M from two VCs to do the deal.

- Intellibot, a maker of industrial-grade robotic cleaning devices, was acuired by Swiss Sealed Air for an undisclosed amount.

- ABB, one of the robotic industry’s Big Four of robot manufacturers, acquired gomTec for an undisclosed price. ABB simultaneously launched their new two-armed YuMi robot which is specifically oriented to electronics assembly. Both actions signal ABB’s entrance into the collaborative robotics marketplace.

Other:

- Moscow-based Skolkovo announce that they and Chinese Cybernaut Investment Group will jointly develop, finance to the tune of $200M, and market high-tech Russian innovations to be manufactured and sold in China and globally.

The Chinese Factor:

The Chinese Factor:

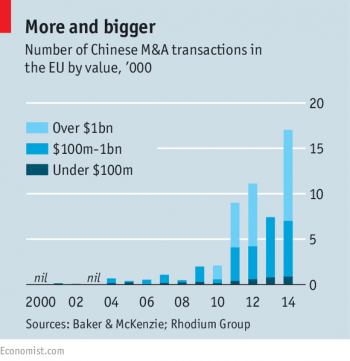

- Note the various acquisitions, investment plans and investment positions made by Chinese investors in the transactions above.

- The Economist recently reported on the growing flow of Chinese money, which is encapsulated in the chart on the right that shows the recent trend, some of which is in the robotics and automation sphere.

tags: c-Business-Finance

Frank Tobe

is the owner and publisher of The Robot Report, and is also a panel member for Robohub's Robotics by Invitation series.

Frank Tobe

is the owner and publisher of The Robot Report, and is also a panel member for Robohub's Robotics by Invitation series.

Related posts :

Robot Talk Episode 141 – Our relationship with robot swarms, with Razanne Abu-Aisheh

Robot Talk

23 Jan 2026

In the latest episode of the Robot Talk podcast, Claire chatted to Razanne Abu-Aisheh from the University of Bristol about how people feel about interacting with robot swarms.

Vine-inspired robotic gripper gently lifts heavy and fragile objects

MIT News

23 Jan 2026

The new design could be adapted to assist the elderly, sort warehouse products, or unload heavy cargo.

Robot Talk Episode 140 – Robot balance and agility, with Amir Patel

Robot Talk

16 Jan 2026

In the latest episode of the Robot Talk podcast, Claire chatted to Amir Patel from University College London about designing robots with the agility and manoeuvrability of a cheetah.

Taking humanoid soccer to the next level: An interview with RoboCup trustee Alessandra Rossi

AIhub and Lucy Smith

14 Jan 2026

Find out more about the forthcoming changes to the RoboCup soccer leagues.

Robots to navigate hiking trails

Christopher Tatsch

12 Jan 2026

Find out more about work presented at IROS 2025 on autonomous hiking trail navigation via semantic segmentation and geometric analysis.

Robot Talk Episode 139 – Advanced robot hearing, with Christine Evers

Robot Talk

09 Jan 2026

In the latest episode of the Robot Talk podcast, Claire chatted to Christine Evers from University of Southampton about helping robots understand the world around them through sound.

Meet the AI-powered robotic dog ready to help with emergency response

Texas A&M University

07 Jan 2026

Built by Texas A&M engineering students, this four-legged robot could be a powerful ally in search-and-rescue missions.

MIT engineers design an aerial microrobot that can fly as fast as a bumblebee

MIT News

31 Dec 2025

With insect-like speed and agility, the tiny robot could someday aid in search-and-rescue missions.