Robohub.org

Recent robotics transactions

photo: KMel Robotics

New Chinese robotics investment fund; the RIA says 2014 North American robotics set new sales record; marine robotics company gets acquired. These stories and many more …

Kmel Robotics, the Pittsburgh-based flying entertainment robot startup that became famous when they did a show using a swarm of lighted drones at the Cannes Film Festival, sold to chipmaker Qualcomm for an undisclosed amount. Qualcomm recently partnered with TechStars to set up a San Diego-based accelerator that plans to annually fund up to a dozen robotic startups.

TM-100 robot from Harvest Automation

A Sole Source Notice of DARPA contracting with KMel to provide a fleet of fast lightweight autonomous (FLA) mini drones may have forced KMel partners to seek funding and partners to scale up. We won’t know the real reason or amounts involved until Qualcomm provides that information in their quarterly SEC filing.

Harvest Automation, located just outside of Boston, is getting $2.9 million as part payment in an as-yet uncompleted funding round to start a new product branch: the OmniVeyor, a mobile device focused on e-commerce companies moving items around their warehouses. According to the Boston Business Journal, Harvest Automation has already raised $25 million for their agricultural robots and have sold over 100 of them to more than 30 farms around the U.S. with an active sales program underway to increase those numbers significantly.

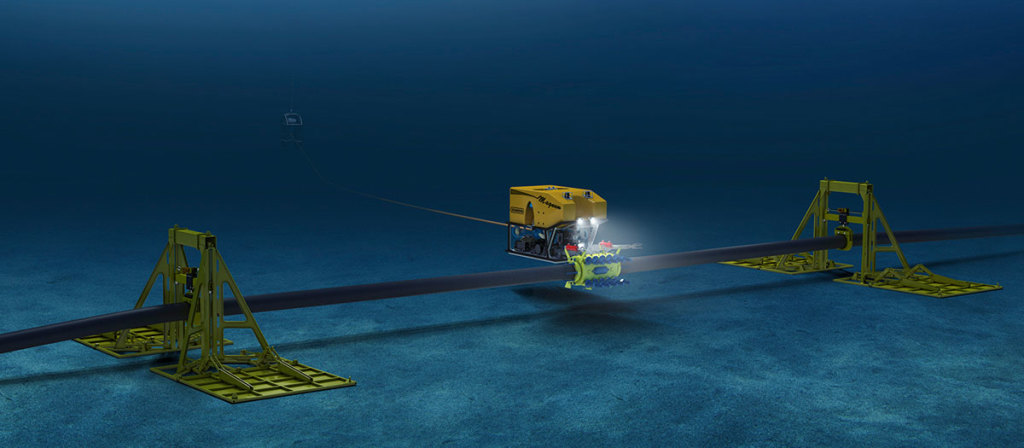

photo: Oceaneering

Oceaneering International, the Houston-based marine engineering and services company serving the offshore oil and gas industry, is buying C & C Technologies for $280 million. In the image above, one can see all the drilling, rig and oil and gas operations going on in offshore deep waters. Lafayette, LA-based C & C provides ocean-bottom mapping and survey services using customized AUVs (autonomous underwater vehicles). Oceaneering has a fleet of ROVs and AUVs and a design and manufacturing unit that makes ROVs and expects to maximize use of those ROVs in support of the mapping and survey services C & C provides. The acquisition is anticipated to be completed in early April. C & C’s sister company ASV (Autonomous Surface Vehicles) is not involved in the Oceaneering acquisition.

The Robotics Industries Association (RIA) reported that 2014 was the strongest year ever for North American robotics. Their detailed statistics will be sent to the International Federation of Robotics (IFR), combined with other data, and compiled into the IFR’s annual report of industrial and service robotics.

27,685 robots valued at $1.6 billion were ordered from North American companies during 2014, an increase of 28% in units and 19% in dollars over 2013. Robot shipments also set new records, with 25,425 robots valued at $1.5 billion being shipped. Shipments grew 13% in units and 6% in dollars over the previous records set in 2013.

The automotive industry was the primary driver of growth in 2014, with robot orders increasing 45% year over year. Non-automotive industries also grew at 7% over 2013. Plastics and Rubber (25%), Semiconductor and Electronics (21%), and Metals (16%) were the prominent non-automotive industries.

According to Alex Shikany, Director of Market Analysis for RIA, the fastest growing applications for robot orders in North America in 2014 were Arc Welding (+58%), Spot Welding (+57%), Assembly (+16%), and Material Handling (+11%). RIA estimates that some 230,000 robots are now at use in United States factories, placing the US second only to Japan in robot use.

Han’s Laser Technology, a Chinese provider of laser processing equipment for marking, welding, cutting, drilling and solar, has, according to China Money Network, partnered with Guosen H&S Investment Company Limited, the private equity arm of state-owned financial service company Guosen Securities Company Limited, to establish a new $160 million fund to invest in the Chinese robot and artificial intelligence sector. Han’s Laser employs 6,200 people and plans to use the fund to improve its competitiveness in high-tech sectors such as laser systems integration, linear motors and visual identity.

Resort Savers RSSV, a Chinese companies that acquires market-ready petroleum industry technologies for installation and distribution in China, particularly technologies to clean oil storage units and recover usable oil, invested $2 million for a 20% share of Worx America, a designer of automated and robotic solutions that help improve efficiency and systems output for the energy industry. The Worx automated robotic system quickly cleans and recovers clean oil from container waste sludge, resulting in increased sales and decreased tank cleaning time giving RSSV the ability to offer proprietary solutions for onshore, offshore and subsea oil production, refining, cleaning and reclamation.

tags: c-Business-Finance, DARPA, Harvest Automation, ifr, kmel robotics, RIA