Robohub.org

Consumer and B2B drone making is big business

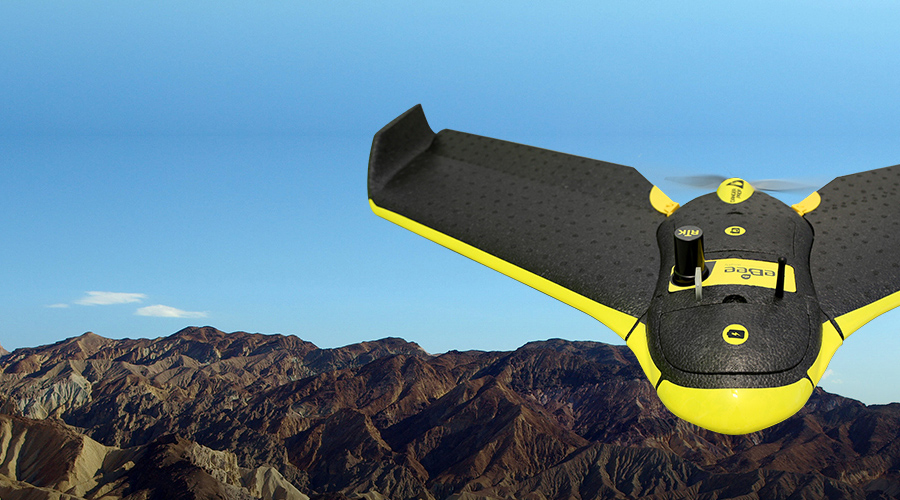

eBee RTK, photo:senseFly

Lobbying for drone special interests rose from $35 million in 2011 to more than $186 million in 2014. But that is dwarfed by investments in drone makers such as DJI and 3DR, who just raised $75M and $64M.

Originally all the lobbying was on behalf of companies providing drones to government defense, security and space agencies. Recently that has changed to lobbying on behalf of commercial uses in agriculture, construction, search and rescue, real estate, movie making, and a myriad additional areas of consumer and non-defense business uses. Amazon and Google now lobby in addition to Boeing, Northrop and Lockheed.

Many research reports forecast compounded annual growth rates (CAGR) of as much as 109% for the remainder of the decade. They foresee the drone industry splitting into maker and service providers, similar to the robotics industry of today where a few big firms make the basic industrial robot arms but thousands of independent global consultants, distributors, integrators and engineers add value through software and add-on devices. In the drone world the service provider segment is growing as fast as the maker group. Mapping, data mining, data analysis, sensor manufacturers and aerial service providers are beginning to do today for the drone industry what integrators and distributors have done for the robotics industry in the past.

Little-known facts from The Oxford Club:

- Right now, the Air Force has between 65,000 and 70,000 people working to process drone-collected data and footage.

- Cape Canaveral is now a drone base.

- U.S. Customs and Border Protection fly drones on our northern, southern and southeastern borders.

There are many drone makers, but few producing large quantities. France’s Parrot sells the AR.Drone and their new line of mini-drones (plus senseFly’s eBee); San Diego-based 3D Robotics just added their new Solo quadcopter to their line of drones and autopilots; China’s Hubsan has a line of drones including their popular mini-copters; and DJI – all sell hundreds of thousands of drones a year.

SZ DJI Innovations

DJI Inspire

Recently I reported that DJI, the Chinese dronemaker that was projecting 2015 sales at $1 billion, was seeking scale-up funding. They just got it from Accel Partners, a Silicon Valley venture capital firm who also has an impressive track record: 23 IPOs and 106 acquisitions for their 385 portfolio companies.

In a tweet by Fortune Magazines’s Dan Primacy, the $75 million DJI received was based on a valuation of $8 billion. The $75M from Accel brings DJI’s total funding to $105M.

“We spent over a year really looking at the UAV market and advanced robotics in general” says Accel partner Sameer Gandhi, who led the raise. “We met over 100 companies and the result was that we have strong convictions that there’s a huge new global market to be built here. There’s a very unique company that’s already by far the market leader: DJI.”

3D Robotics

3D Robotics, the San Diego-based open-source UAV technology company and community headed by Chris Anderson and Jordi Munoz, received a $50 million Series C round of funding in February but got another $14M as an add-on to that thereby closing their Series C funding at $64M, and a total funding to date of $99 million.

Founded in 2009, the company currently has over 275 employees and more than 100,000 customers worldwide.

3DR just launched a new quadcopter called the Solo Smartcopter with computer-assisted flight and advanced camera control.

tags: c-Business-Finance, cx-Aerial