Robohub.org

Enrico Krog Iversen’s impact on the robotics industry

Odense Robotics Cluster.

Denmark is a country with less than 6 million people but a very successful working robotics cluster that performs as a funder, equalizer and instigator. Denmark is 6th in global robot density (a measure of the number of multi-purpose industrial robots per 10,000 employees in the manufacturing sector) behind Korea, Singapore, Germany, Japan, and Sweden, yet Denmark doesn’t have an auto industry contributing to those figures.

Clusters are a big thing in the incubation, support, funding and nurturing of roboticists and their endeavors. There are many stakeholders in the Danish cluster:

Companies that use robots

Governmental agencies that want to turn technology into tax-paying entities and jobs

Engineers and entrepreneurs who want to learn and be inspired by successes and about the startup scene

Students who want to see where the jobs are; executives who want good local talent and help in navigating local regulations

Investors who want to participate in the space

Educators who want to know there will be uses for their research, training and students

Cooperation between the various government-sponsored organizations, local universities and hundreds of robotics-related companies is what makes the overall Danish cluster successful. See how extensive it is by enlarging the image atop this page.

Clusters often ride on the coattails of successful companies. This is certainly the case with the Odense Cluster (the largest sub-set of the Danish robotics support system). Universal Robots (UR) has become a country-wide leader in Denmark and particularly in Odense, where it is headquartered and where it employs 500-plus people. In 2015, Universal Robots sold to an American supplier of test equipment, Teradyne, for $365 million, making many of UR’s top people multi-millionaires. And those very same people are already reinvesting some of their money in new ventures in Odense and throughout Denmark including MiR Mobile Industrial Robots (which also recently sold to Teradyne for $272 million), and OnRobot (more on this company below).

New e Series cobots from @Universal_Robot at #Automatica. Here’s the new UR5e with new safety features, integrated force torque sensors and better repeatability. pic.twitter.com/jo90zHDRrC

— The Robot Report (@therobotreport) June 19, 2018

Another mark of a good robotics cluster is the ability to provide local, regional and international media with timely newsworthy facts and figures; not just generic publicity but real information. Universal Robots is a classic example: from their beginning they had a network of PR firms working for them and operating from a policy of always providing real information, no matter the situation or circumstance. By being a small-knit community, the very same network of PR firms that helped promote UR are now promoting MiR, OnRobot, and many others.

There are multiple robotics clusters around the world successfully providing for the needs of their respective communities (and a few not really achieving their desired goals). Odense and the Danish Cluster certainly fall into the former category. In my opinion, they do so because they are organized at every level to be offering and have people in place that are business smart, humble and cooperative in approach, and public-spirited and generous in nature.

Enrico Krog Iversen, CEO of UR from 2008 through the sale to Teradyne in 2015, fits those descriptors and has been a participant, contributor, advisor and also a beneficiary of the Danish Cluster.

[Editor’s NOTE: To become acquainted with the Danish and Odense Cluster, consider attending their Investor Summit on September 12th and R-18 Robot Fair on September 11-13 in Odense.]

OnRobot CEO Enrico Krog Iversen. (Credit: OnRobot)

Enrico Krog Iversen: Leading UR’s Transition

Krog Iversen worked for many years with Denmark’s largest company, Moeller/Maersk, earned an MBA from the University of Southern Denmark, and was a partner and Sales Director at Krog Iversen, a manufacturer of heating stoves, a business he and his family sold in 2006. He was 10+ years older than the two partners in Universal Robots in 2008 when, with funding from The Danish Growth Fund, he joined the company as CEO.

The Danish Growth Fund brought Enrico in to help salvage and take over leadership of a failing company with a great product. The floundering UR had a business plan to (1) do all to help their customers customize their robots for their applications; (2) to create a secondary profit center similar to the Apple App Store for all the necessary accessories (grippers, covers, cameras, sensors, stands, etc.); and (3) to provide comprehensive service and repair.

Krog Iversen believed that letting integrators and distributors do the hands-on work and provide all the accessories and customization for the end users allowed UR to concentrate on the least number of products to manufacture with the fewest, if any, options.

His formula made for efficient manufacturing but required a network of integrator-type distributors, which he and his VP of sales, Thomas Visti, cultivated and compiled. Krog Iversen’s revised business plan was a key transition point for UR: deciding not to be involved in how its robots would be configured to meet end-user needs.

This focus on manufacturing efficiencies and product testing carried forward as unit sales increased from hundreds to thousands and by late 2010, after only three rounds of funding and a serious global financial crisis, UR became profitable and was self-funded thereafter. In 2015, Teradyne acquired UR for $365 million and at the beginning of 2016, he left to explore other opportunities.

The same set of integrator/distributors developed and utilized by UR was used to jump-start sales at MiR Mobile Industrial Robots by MiR founder Visti.

Spearheading OnRobot Merger

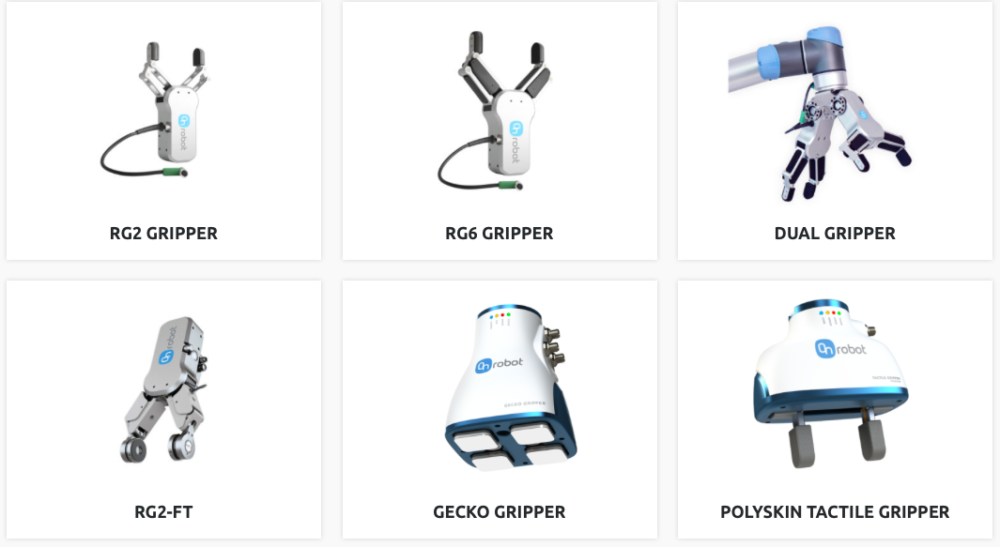

The newly-merged, Odense-based OnRobot is also using the same group of integrators to boost the sale of their line of end-of-arm products. OnRobot – a merger of US-based Perception Robotics, Hungary-based OptoForce, and Denmark-based OnRobot – has two goals: (1) to provide everything that goes on a robot and (2) be the leading collaborative end-of-arm tooling company in the world.

“Collaborative robots have the potential to become the comprehensive standard in industrial automation. We want to make collaborative applications even easier to implement and to take them into completely new areas of application – all from one source and all with a single user interface,” said Enrico Krog Iversen, CEO of the new OnRobot.

Ambitious, yes, but timely, well-connected, and well on its way with sales up 200% year-over-year, and plans to continue at that pace for quite some time. OnRobot makes and integrates grippers, sensors and other co-bot equipment to facilitate the use of the resulting technology in applications such as packaging, quality testing, material handling, machine tending, assembly and welding, and is planning to acquire and manufacture additional technologies such as vision and sensor systems and provide worldwide support.

OnRobot’s lineup of robotic grippers. (Credit: OnRobot)

OnRobot’s new gripper from partner Perception Robotics utilizes adhesion like on a gecko’s foot. It is an example of the value of the merger: the new gripper is perfect for handling ceramic tiles, screens, windscreens or lids of cosmetics. Pick-and-place tasks such as moving solar panels, or those in glass production or sheet metal processing, can be automated extensively for the first time because of the unique adhesive capabilities of the Gecko Gripper, which this summer won the prestigious IERA Award for Robotics and Automation.

Stepping up his board memberships, funding, consulting and advising activities since the sale of UR, Krog Iversen now serves as the CEO of the new OnRobot. He brings a wealth of robotics experience, contacts and business wisdom to what could be a future business of significance. The niche business that Iversen shunned for UR, is now being heralded for OnRobot.

As robot arms become less expensive and their control systems more open and flexible, end-of-arm tools (vision and sensor systems, tool changers, apps, and grippers of all types – all of the items OnRobot makes and sells) become more important. Some academics even say someday soon smart end-of-arm tools may control the robot instead of the other way around.

Thus, Krog Iversen embarks on a new robotics venture with a great set of products, a broad distribution network, a supportive robotics cluster, and lofty goals. We wish him well.